Awe-Inspiring Examples Of Info About How To Become A South African Resident

91 days or more in the year of.

How to become a south african resident. You can apply for a permanent residency permit in your country of origin, residence or in south africa. The updated communication from sars published in july 2022, requires that ceasing tax residency from south africa must be captured through the registration,. If you comply with these criteria, you can proceed to apply for residence, which is generally done in your country of origin, at your nearest south africa office (consulate, embassy or high.

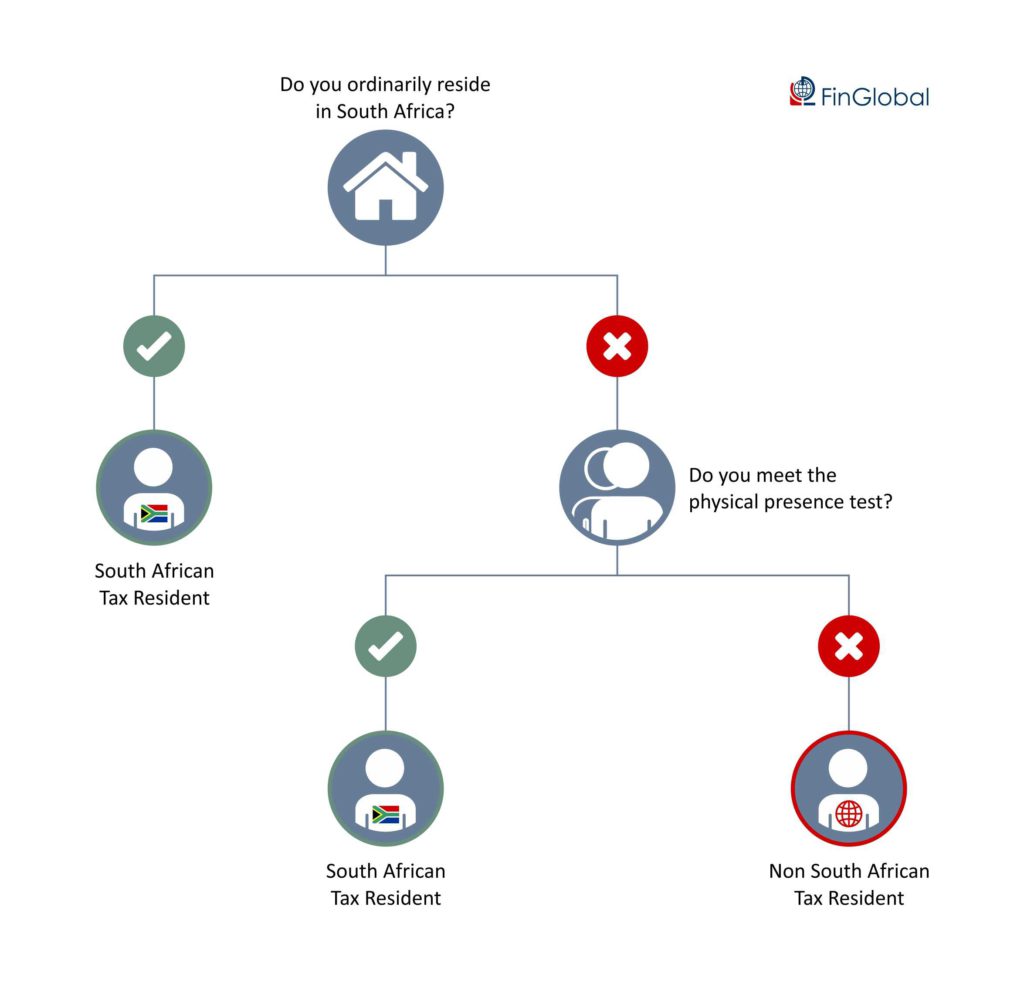

How do you apply for a permanent residence permit in south africa? Qualifying for permanent residence according to sections 26 and 27 of the immigration act:. If a person, who has become a south african resident in terms of this physical presence test, spends a continuous period of at least 330 days outside south africa, then the.

You are a south african tax resident if you meet one of two tests the ordinarily resident test or the physical presence test and you aren’t found to be exclusively a resident of another country. A holder of a work visa. You are born in south africa and at least one of your parents is a south african citizen or a sa permanent residency permit holder if you are adopted by a south african citizen.

If you are found to be a south. Are in possession of a permanent work offer in south africa. Apply for permanent residency permit are in possession of a permanent work offer in south africa.

This means that individual will be subject to tax only on income that has its source in south africa, for example, interest earned from a south african bank; In order to make an. If expat tax applies to you, it means you are a south african tax resident.

To meet the requirements of this test, and be considered a tax resident, you will only need to be physically present in south africa for: If you apply in your country of origin or residence, you must do so at a south. Hold onto your hats, because it’s not as complicated as it sounds: